Lawyer Insurance Costs in the Future: In the ever-evolving legal profession, lawyer insurance costs remain a critical concern for attorneys and law firms alike. As we navigate 2025 and beyond, understanding the trajectory of these expenses—particularly for lawyers’ professional liability insurance (LPL), also known as legal malpractice insurance—is essential.

This type of coverage protects lawyers from claims of negligence, errors, or omissions in their professional services. With rising litigation trends and economic pressures, future lawyer insurance costs are expected to fluctuate, but savvy strategies can lead to significant savings.

This comprehensive guide explores current trends, key influencing factors, projections for lawyer insurance costs in the coming years, and practical ways to reduce premiums while maintaining robust protection.

Whether you’re a solo practitioner searching for affordable attorney malpractice insurance or a large firm optimizing your risk management, staying informed about lawyer insurance costs in 2025 and future expectations can help you budget effectively and safeguard your practice.

The Current Landscape of Lawyer Insurance Costs

To predict the future, we must first examine the present state of lawyer insurance costs. In 2025, the average monthly premium for professional liability insurance for lawyers ranges from $100 to $150, depending on various factors. This is a notable increase from previous years, driven by heightened claim frequencies and larger payouts. For instance, general liability coverage might start as low as $23 per month, but comprehensive LPL policies, which are tailored to the unique risks of legal work, command higher rates.

Recent data indicates that legal malpractice claims have held steady in frequency but seen booming payouts, often outpacing inflation. In 2024, nearly half of reported medical liability premiums rose, a trend that spills over into legal fields due to similar underwriting principles. For lawyers, this translates to annual premiums that can exceed $5,000 for small firms and soar into the tens of thousands for larger practices specializing in high-risk areas like litigation or corporate law.

The global liability insurance market, which encompasses lawyer insurance, was valued at $290.5 billion in 2024 and is projected to reach $524.66 billion by 2034. This growth reflects broader economic shifts, including inflation and increased legal interventions. Attorneys in states with litigious environments, such as California or New York, face steeper costs compared to those in less lawsuit-prone areas.

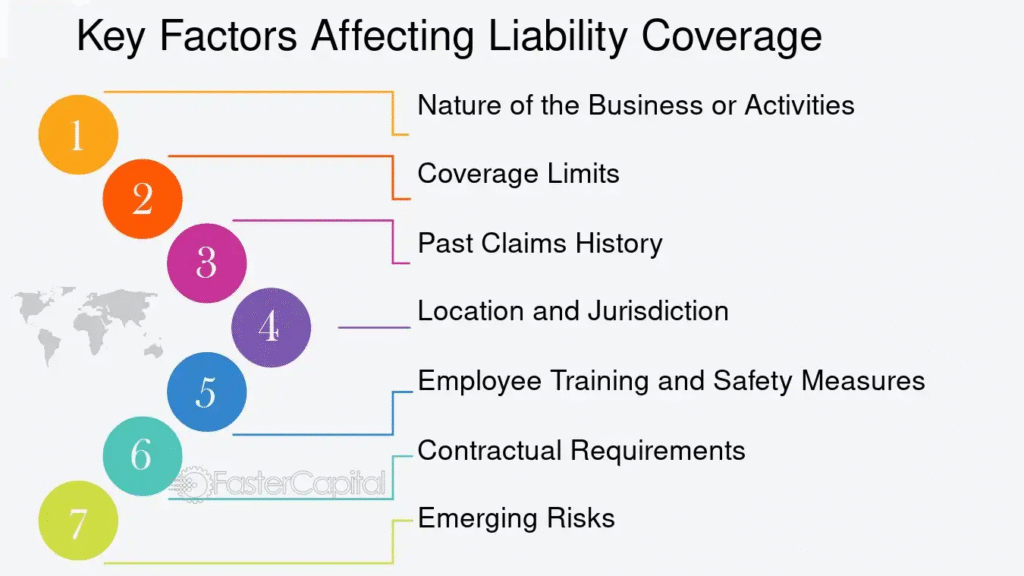

Key Factors Influencing Lawyer Insurance Premiums

Several elements determine the cost of lawyer insurance, and understanding them is crucial for anticipating future trends. These factors not only affect current rates but also shape expectations for lawyer insurance costs in the years ahead.

- Industry and Type of Services Provided: The nature of your legal practice plays a pivotal role. High-risk specialties like personal injury or intellectual property law attract higher premiums due to the potential for large claims. In contrast, transactional lawyers or those in estate planning might enjoy lower rates.

- Business Size and Annual Revenue: Larger firms with more attorneys and higher revenues are seen as greater risks, leading to elevated premiums. Firm size directly impacts rates, as more lawyers mean more potential exposure. Annual hours worked and billing volume also factor in, with busier practices paying more.

- Claims History: A clean record can significantly lower costs, while past claims increase premiums. Insurers view businesses with prior incidents as higher risks, often resulting in surcharges.

- Geographic Location: State and even county-specific legal climates influence rates. Areas with frequent lawsuits or higher jury awards, like urban centers, drive up costs. For example, lawyers in New York might pay 20-30% more than those in rural states.

- Coverage Limits and Deductibles: Higher limits provide more protection but come at a steeper price. Conversely, opting for a higher deductible can reduce premiums.

- Risk Management Practices: Firms with strong internal controls, such as conflict-of-interest checks and docket systems, may qualify for discounts.

- Economic and Market Conditions: Broader trends like inflation, legal fee escalations, and claim volumes affect premiums. Recent reports highlight how sophisticated attorney tactics and erosion of tort reforms contribute to rising costs.

These factors create a dynamic pricing environment, where lawyer insurance costs can vary widely. For instance, a solo attorney in a low-risk state might pay $1,200 annually, while a mid-sized firm in a high-litigation area could face $20,000 or more.

Future Expectations for Lawyer Insurance Costs

Looking ahead, what can lawyers expect from insurance costs in 2026 and beyond? Industry projections suggest a mixed outlook, with moderate increases tempered by market competition and technological advancements.

For 2025, LPL insurance rate increases are expected to align with 2024 levels, potentially ranging from 5% to 20% in high-risk sectors. This consistency stems from stabilizing markets, though new capital entrants are approaching cautiously. However, trends indicate that malpractice premiums could continue rising due to escalating legal fees, larger payouts, and economic inflation.

One major driver is “social inflation,” where litigation costs have surged 57% over the past decade, outpacing economic inflation. This phenomenon, peaking at 7% in 2023, is fueled by attorney involvement in claims, which increases resolution times and expenses. For lawyers, this means higher defense costs and, consequently, elevated premiums.

Emerging risks like cybersecurity threats and AI-related liabilities are also poised to impact future lawyer insurance costs. As law firms digitize operations, cyber insurance add-ons could become standard, adding 10-15% to overall premiums. Additionally, the rise of remote work and virtual consultations may introduce new claim vectors, prompting insurers to adjust rates upward.

On a positive note, the legal industry is shifting toward proactive risk management. Law firms are investing more in technology, marketing, and knowledge management—strategic moves that could mitigate risks and stabilize costs. By 2030, experts predict that integrated tech solutions, such as AI-driven conflict checks, could reduce claim frequencies by up to 20%, potentially leading to flatter or even declining premiums for well-prepared firms.

However, challenges persist. Large jury awards are destabilizing markets, and if this trend continues, malpractice rates in 2025 and beyond could see sharper hikes. Overall, future lawyer insurance costs are expected to rise modestly at 3-7% annually through 2030, influenced by inflation and litigation trends, but offset by competitive underwriting and firm-level innovations.

Strategies to Achieve Savings on Lawyer Insurance

While future costs may trend upward, there are numerous ways to save on attorney malpractice insurance without compromising coverage. Implementing these strategies can yield substantial reductions, potentially lowering premiums by 10-30%.

- Shop Around and Compare Quotes: Don’t stick with the same insurer year after year. Comparing options from multiple providers can uncover better rates. Use authorized insurers in your state to ensure compliance.

- Opt for Higher Deductibles: Assuming more risk upfront reduces monthly premiums. For example, increasing your deductible from $1,000 to $5,000 might save hundreds annually.

- Enhance Risk Management Practices: Adopt systems like central docket calendars and conflict-of-interest procedures to minimize errors. Insurers often offer discounts for such measures.

- Purchase Tail Coverage Wisely: For retiring attorneys or those switching policies, tail insurance extends coverage for past acts. Buying it strategically can prevent gaps and avoid higher future rates.

- Bundle Policies: Combining LPL with other coverages like cyber or general liability can lead to multi-policy discounts.

- Maintain a Clean Claims Record: Proactive client communication and thorough documentation reduce claim likelihood. Programs like malpractice avoidance training can further lower risks.

- Leverage Technology: Invest in practice management software to streamline operations, which can qualify for premium credits.

- Consider Defense Costs Outside Limits: Policies where defense expenses don’t erode coverage limits provide better value, especially for high-exposure firms.

By focusing on these savings tactics, lawyers can offset expected cost increases. For instance, a firm implementing robust risk protocols might save 15% on premiums, translating to thousands in annual savings.

Conclusion: Preparing for Tomorrow’s Lawyer Insurance Landscape

As we look toward the future, lawyer insurance costs are set to evolve amid economic pressures, technological shifts, and litigation trends. Expectations point to moderate rises in 2025 and beyond, driven by factors like social inflation and emerging risks, but opportunities for savings abound through smart risk management and strategic purchasing.

Attorneys who stay proactive—by understanding influencing factors, adopting best practices, and regularly reviewing policies—can navigate these changes effectively. Ultimately, investing in quality lawyer insurance not only protects your practice but also ensures long-term financial stability. For personalized advice, consult with insurance specialists to tailor coverage to your needs.