Interest-Free Asaan Loan Scheme: In a bold move to revolutionize small business financing in Pakistan, Chief Minister Punjab Maryam Nawaz Sharif launched the Maryam Nawaz Scheme in early 2025. Officially known as the CM Punjab Asaan Karobar Finance Scheme, this initiative stands out as a game-changer for aspiring entrepreneurs and small-to-medium enterprises (SMEs).

What makes it truly remarkable? It’s 100% interest-free, offering loans ranging from PKR 100,000 to a whopping PKR 30 million (Rs. 3 crore) without the burden of compounding interest rates that often cripple startups. As Pakistan grapples with economic challenges, this scheme aligns with Maryam Nawaz’s vision of inclusive growth, job creation, and poverty alleviation. If you’re searching for interest-free business loans in Punjab or wondering how to apply for the Asaan Karobar Loan Scheme, this comprehensive guide breaks it all down.

Launched on January 14, 2025, during the 22nd Provincial Cabinet Meeting, the scheme has already approved over 80,000 applications, disbursing loans to more than 34,000 individuals. Backed by a massive PKR 84 billion allocation, it’s not just financial aid—it’s a catalyst for economic revival in Punjab, Pakistan’s economic powerhouse. In this article, we’ll explore the scheme’s origins, features, eligibility, application process, and real-life impact, ensuring you have everything you need to kickstart your business dream.

The Genesis of the Maryam Nawaz Asaan Loan Scheme: A Response to Economic Urgency

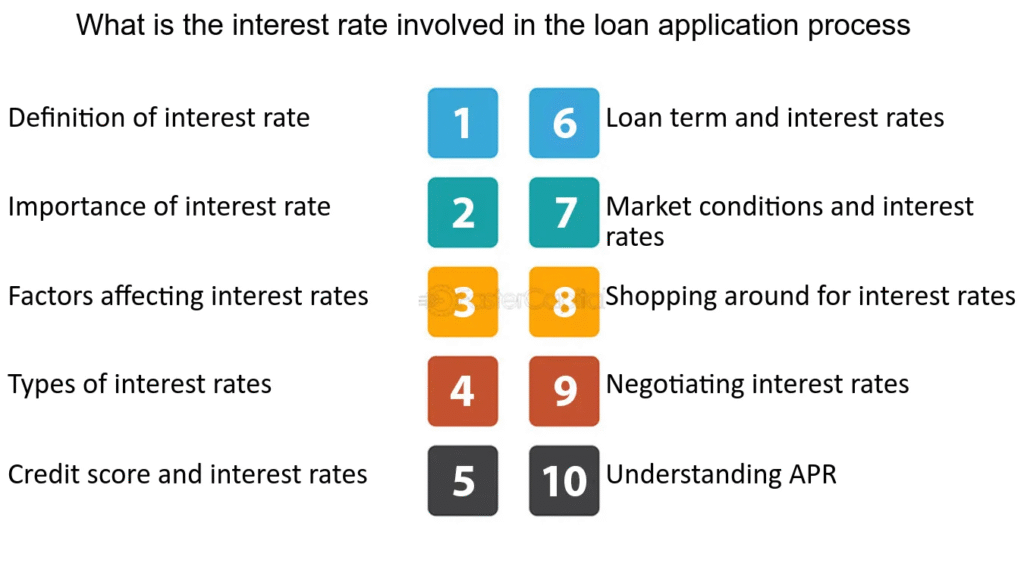

Pakistan’s economy has faced turbulent times, with SMEs—contributing over 40% to the GDP—struggling under high interest rates (often 20-25%) and limited access to capital. Enter Maryam Nawaz, Punjab’s first female Chief Minister, whose leadership emphasizes youth empowerment and entrepreneurial freedom. Drawing from her experience in the Prime Minister’s Youth Programme (which she headed under Nawaz Sharif), the Asaan Loan Scheme builds on proven models but goes further by eliminating interest entirely.

The scheme was born out of a dire need: Before the PML-N government’s resurgence, Pakistan teetered on the brink of default, with economic growth stagnating below 2%. Maryam Nawaz, in her inauguration speech, highlighted how interest-free financing could mirror the 5.7% growth rates seen during her father Nawaz Sharif’s tenure. “Get a loan today and start your business tomorrow,” she declared, underscoring the scheme’s no-collateral, quick-approval ethos.

Complementing the main finance scheme is the Asaan Karobar Card, a digital tool for smaller loans up to PKR 1 million, targeting over 100,000 micro-entrepreneurs. Together, these form the backbone of Punjab’s 2025 economic reform package, prioritizing sectors like agriculture, IT startups, and retail. Free land allocation for beneficiaries further sweetens the deal, making it easier to set up shop without bureaucratic hurdles.

Key Features of the Asaan Loan Scheme: Why It’s a Boon for Startups

The Maryam Nawaz Asaan Loan Scheme isn’t your typical bank loan—it’s designed for accessibility and sustainability. Here’s what sets it apart:

1. Interest-Free Financing: Zero Burden on Borrowers

At the heart of the scheme is its flagship feature: no interest charges whatsoever. Loans are subsidized by the Punjab government, ensuring 100% interest-free disbursement through the Bank of Punjab. Repayments are structured in easy monthly installments over 3-5 years, with a 3-month grace period for the Asaan Karobar Card. For larger loans (up to Rs. 3 crore), repayments span up to 5 years, with minimal late fees (PKR 1 per PKR 1,000 per day) to encourage timely payments without punitive measures.

2. Flexible Loan Amounts for Every Scale

- Micro-Loans via Asaan Karobar Card: Up to PKR 1 million for 3 years—ideal for street vendors, home-based businesses, or digital startups.

- SME Loans: PKR 100,000 to PKR 10 million for expanding operations.

- Enterprise Loans: Up to PKR 30 million for agriculture, manufacturing, or export-oriented ventures.

Funds are disbursed digitally, restricted to business use (e.g., inventory, equipment), and monitored via the card’s platform to prevent misuse.

3. Streamlined Approvals and Minimal Documentation

Forget endless paperwork. No immediate need for NOCs, licenses, or property maps—apply with basic docs like CNIC and a business plan. Approvals take 3-4 weeks, with physical verification by the Urban Unit within 6 months. A clean credit history is required, but defaulters on utility bills are excluded to ensure fair distribution.

4. Targeted Support for Key Sectors

Priority goes to youth (18-45 years), women entrepreneurs, and rural businesses. IT startups in Nawaz Sharif IT City get preferential rates, while agriculture benefits from integrated subsidies like the Kisan Card (now up to PKR 300,000 interest-free). The scheme also ties into broader initiatives, like free 3-marla plots for homeless beneficiaries under the Apni Chhat Apna Ghar program.

5. Digital Integration and Transparency

The Asaan Karobar Card functions like a debit card for business expenses, with real-time tracking via the official portal (akc.punjab.gov.pk). Helpline 1786 provides round-the-clock support, and applications are processed on a first-come, first-served basis.

These features make the Asaan Loan Scheme a beacon for interest-free startup loans in Pakistan, directly addressing barriers that stifle 70% of new businesses within their first year.

Eligibility Criteria: Who Can Apply for Maryam Nawaz Asaan Loans?

Accessibility is key, but the scheme ensures funds reach genuine entrepreneurs. Here’s a quick eligibility checklist:

| Criterion | Details |

|---|---|

| Residency | Must be a Punjab domiciled Pakistani national. |

| Age | 18-60 years (priority for youth under 45). |

| Business Type | Existing or new SMEs with annual turnover up to PKR 800 million. |

| Credit History | Clean record; no defaults on loans, utilities, or taxes. |

| Documentation | Valid CNIC, domicile certificate, business plan, and bank account details. |

| Exclusions | Government employees, large corporations, or those with prior defaults. |

Women and rural applicants receive 20% quota reservations, promoting gender and regional equity. For the Asaan Karobar Card, a registered mobile number and personal digital guarantee suffice.

Step-by-Step Application Process: How to Secure Your Interest-Free Loan

Applying for the Maryam Nawaz Asaan Loan Scheme is as easy as it gets—fully online, no queues. Follow these steps:

- Visit the Official Portal: Head to akc.punjab.gov.pk or cmpunjabfinance.punjab.gov.pk. Select “Asaan Karobar Finance” or “Asaan Karobar Card.”

- Register and Fill the Form: Enter CNIC, personal details, business info, and desired loan amount. Upload a simple business plan (template available on-site).

- Submit Documents: Scan and attach CNIC, domicile, proof of business (if existing), and bank details. For cards, e-sign the personal guarantee.

- Pay Nominal Fee: PKR 500-1,000 processing fee (waived for women in some cases).

- Track and Await Approval: Get a reference number via SMS. Verification takes 1-2 weeks; funds hit your account in 3-4 weeks.

- Post-Approval: Use funds via the card or direct transfer. Annual audits ensure compliance.

Pro Tip: Apply early—funds are limited, and Phase 2 (launched mid-2025) prioritizes high-impact proposals. For queries, dial 1786 or visit Bank of Punjab branches.

Real-Life Impact: Success Stories from Punjab Entrepreneurs

The scheme’s true power lies in its transformations. Take Syed Muhammad Abdullah from Faisalabad: A 22-year-old aspiring car showroom owner, he secured a PKR 30 million loan in just 3-4 weeks. “CM Maryam Nawaz’s initiative turned my dream into reality,” he shared on X. Now employing 10 locals, his business boosts local exports.

Or consider small vendors: Over 34,000 have received funds, creating 200,000+ jobs province-wide. In rural Bahawalpur, a furniture entrepreneur expanded his showroom with PKR 3 million, crediting the no-interest model for his 50% revenue jump.

Women beneficiaries shine too: A Multan tailor used PKR 250,000 to scale her home-based shop, employing three women from her community. These stories echo across X, with users praising the scheme’s transparency and speed.

Economically, it’s projected to add PKR 500 billion to Punjab’s GDP by 2027, reducing unemployment from 12% to under 8%.

Challenges and the Road Ahead: Ensuring Sustainable Growth

No scheme is perfect. Early challenges included application glitches (resolved by March 2025) and urban bias in disbursements. Maryam Nawaz addressed this by allocating 40% funds for rural areas and launching Phase 2 with enhanced monitoring. Critics note the PKR 84 billion budget strains provincial coffers, but proponents argue the ROI—via taxes and jobs—outweighs costs.

Looking ahead, integration with federal programs like Kamyab Jawan could amplify reach. Maryam Nawaz’s commitment to audits and impact evaluations ensures accountability, positioning the Asaan Loan Scheme as a model for national replication.

Conclusion: Seize Your Opportunity with Maryam Nawaz Asaan Loans Today

The Maryam Nawaz Asaan Loan Scheme is more than financing—it’s empowerment. By offering interest-free business loans up to Rs. 3 crore, it dismantles barriers for Punjab’s dreamers, fostering a vibrant SME ecosystem. Whether you’re a young innovator in Lahore or a farmer in Multan, this scheme invites you to build tomorrow.

Don’t wait—applications are open at akc.punjab.gov.pk. With Maryam Nawaz at the helm, Punjab isn’t just recovering; it’s thriving. Apply now, start your business, and be part of Pakistan’s economic renaissance. For more on Asaan Karobar loans or interest-free SME financing, stay tuned to official channels. Your success story could be next!