Guide to Lawyers’ Professional Liability Insurance. In the fast-paced world of legal practice, where decisions can have life-altering consequences for clients, protecting your career and firm is paramount. Professional liability insurance for lawyers, often referred to as legal malpractice insurance, serves as a critical safety net against claims of negligence, errors, or omissions in professional services.

As of 2025, with rising litigation costs and evolving regulatory landscapes, understanding this coverage is essential for attorneys at all levels—from solo practitioners to large firms. This comprehensive guide explores everything you need to know about professional liability insurance for lawyers, including what it covers, why it’s necessary, cost factors, common claims, and tips for selection and risk reduction. Whether you’re a new attorney or an experienced partner, arming yourself with this knowledge can safeguard your practice and provide peace of mind.

What is Professional Liability Insurance for Lawyers?

Professional liability insurance for lawyers is a specialized form of errors and omissions (E&O) insurance tailored to the legal profession. It protects attorneys and law firms from financial losses arising from claims that their professional services caused harm to clients due to mistakes, oversights, or negligent acts. Unlike general liability insurance, which covers bodily injury or property damage, this policy focuses on the intangible aspects of legal advice and representation.

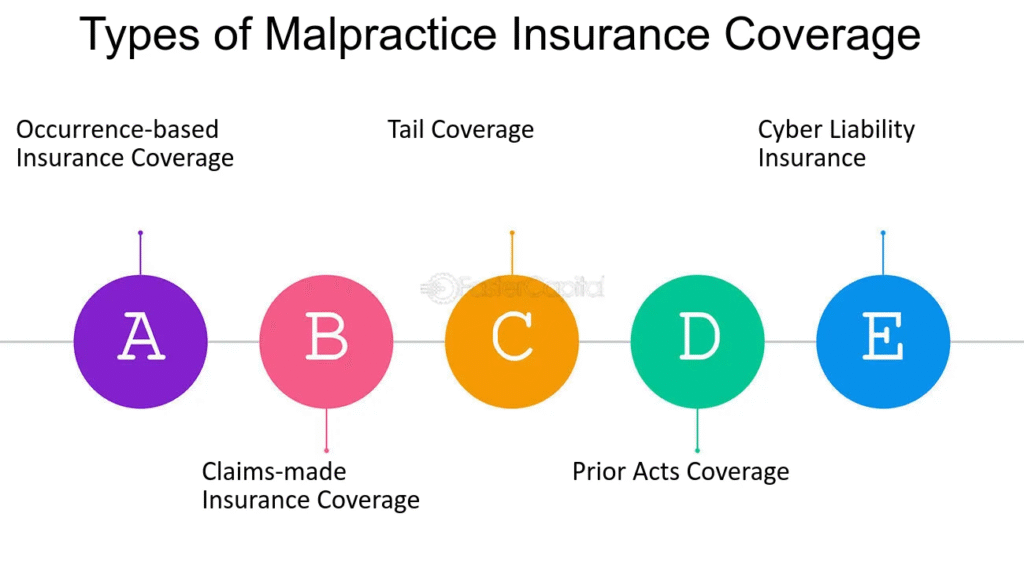

At its core, legal malpractice insurance operates on a “claims-made” basis, meaning coverage applies to claims reported during the policy period, regardless of when the alleged error occurred—provided the incident happened after the policy’s retroactive date. This structure ensures that past work is protected as long as the policy is active. Key components include defense costs, which cover legal fees to fight claims, and indemnity payments for settlements or judgments.

For part-time or solo lawyers, policies often include a duty to defend, indemnification, and supplemental payments for expenses like court costs. Exclusions typically involve intentional misconduct, criminal acts, or non-legal services. In essence, this insurance acts as a buffer, allowing lawyers to focus on advocacy without the constant fear of ruinous lawsuits. As the legal field grows more complex with digital records and remote work, having robust coverage is non-negotiable for maintaining professional integrity.

Why Do Lawyers Need Professional Liability Insurance?

No attorney is immune to mistakes, and even the most diligent can face allegations of malpractice. Professional liability insurance for lawyers is crucial because it mitigates the financial devastation from client claims, which can include lost cases, missed deadlines, or poor advice. In 2025, with increased client expectations and regulatory scrutiny, uninsured lawyers risk personal assets, including savings and property, to cover defense and damages.

State requirements vary; for instance, some states like Ohio mandate minimum coverage of $100,000 per occurrence and $300,000 aggregate for certain practices. However, even where not required, it’s a best practice—many clients and bar associations expect it. Without insurance, a single claim could bankrupt a firm, especially for solos who lack the resources of larger entities.

Beyond financial protection, this insurance enhances credibility. It signals to clients that you’re committed to accountability, potentially attracting more business. In high-stakes areas like estate planning or litigation, where errors can lead to significant client losses, coverage is indispensable. Ultimately, in an era of rising lawsuits, professional liability insurance for lawyers isn’t just optional—it’s a cornerstone of sustainable practice.

Key Coverage Details in Legal Malpractice Insurance

Understanding the nuances of coverage is vital when selecting professional liability insurance for lawyers. Most policies cover negligence, errors, and omissions in rendering legal services, including advice, document preparation, and court representation. This includes defense against allegations of breach of duty, such as failing to file timely or providing inaccurate counsel.

Standard features include limits per claim and aggregate, deductibles, and extended reporting periods (tail coverage) for claims after policy expiration. For example, if a lawyer retires, tail coverage ensures protection for prior acts. Policies may also extend to cyber liability, given the prevalence of data breaches in law firms.

Exclusions are equally important: intentional fraud, dishonest acts, or non-professional services like investment advice are typically not covered. Some policies offer endorsements for specific risks, such as disciplinary proceedings or innocent insured protection, which covers non-culpable partners.

For comprehensive protection, look for claims-made and reported policies, requiring prompt notification of potential claims. In 2025, with AI integration in legal work, policies are evolving to address tech-related errors. Always review the policy’s definitions of “professional services” to ensure alignment with your practice areas.

Factors Affecting the Cost of Professional Liability Insurance for Attorneys

The cost of professional liability insurance for lawyers varies widely, influenced by several key factors. In 2025, premiums range from $2,500 to $3,500 annually for standard coverage, depending on firm size, location, and practice area. High-risk specialties like real estate or securities law often incur higher rates due to frequent claims.

Firm history plays a role; a clean claims record can lower premiums, while prior incidents increase them. Location matters—urban areas with higher litigation rates, like California, cost more than rural ones. Coverage limits and deductibles also affect pricing; higher limits mean higher premiums, but larger deductibles can reduce costs.

For solo attorneys, averages hover around $2,500 per year, while larger firms pay more due to broader exposure. Insurers assess risk through applications detailing practice areas, revenue, and risk management practices. Shopping multiple carriers can yield savings, as rates differ based on underwriting criteria. Overall, investing in robust coverage is cost-effective compared to the potential millions in uncovered claims.

Common Legal Malpractice Claims Against Lawyers

Legal malpractice claims often stem from avoidable errors, highlighting the need for vigilance. The most frequent include missing deadlines, such as statutes of limitations, which can bar client claims entirely. Inadequate research or fact investigation follows, leading to flawed strategies.

Conflicts of interest and poor communication rank high; failing to disclose potential biases or keeping clients uninformed can trigger suits. Estate planning errors, like improper will drafting, surged in 2024, comprising a growing share of claims.

Intentional wrongs, though less common (about 10%), include fraud or civil rights violations. Proving malpractice requires showing duty, breach, causation, and damages—making these “case within a case” scenarios complex. Awareness of these pitfalls underscores the value of professional liability insurance for lawyers in mitigating fallout.

How to Choose the Right Legal Malpractice Insurance Policy

Selecting the best professional liability insurance for lawyers involves careful evaluation. Start by assessing your firm’s risks: practice area, client base, and claims history. Compare at least three carriers for quotes, focusing on costs, limits, and deductibles.

Review policy terms: Ensure claims-made coverage with adequate tail options and no restrictive exclusions. Check the insurer’s financial stability via ratings from A.M. Best. Look for added benefits like risk management resources or cyber endorsements.

Use checklists for purchasers to scrutinize applications and policies. For solos, prioritize user-friendly online applications. Consulting bar association resources can guide choices. The right policy balances comprehensive protection with affordability.

Tips to Reduce Malpractice Risks for Lawyers

Minimizing risks complements professional liability insurance for lawyers. Screen clients thoroughly to avoid high-risk engagements. Use engagement and closing letters to define scopes and expectations.

Communicate regularly, avoiding jargon and documenting all interactions. Implement docketing systems for deadlines and conduct upfront case evaluations. Stay within your expertise—don’t dabble in unfamiliar areas. Regular training and decluttering emails reduce administrative errors.

Conclusion

Professional liability insurance for lawyers is an indispensable tool in navigating the complexities of modern legal practice. By understanding coverage, costs, and risks, attorneys can make informed decisions that protect their futures. In 2025, prioritize policies that evolve with your needs, and pair them with proactive risk management. Secure your practice today for a resilient tomorrow.