Guide to Choosing Travel Insurance. Travel is one of the most rewarding experiences in life, but it also comes with risks. Flight cancellations, medical emergencies, or lost luggage can quickly turn a dream vacation into a nightmare. That’s where travel insurance comes in — a financial safety net designed to protect you against unexpected setbacks.

But with countless providers, policy types, and confusing fine print, the big question remains: How do you choose the right travel insurance plan?

In this detailed guide, we’ll break down everything you need to know about comparing policies, understanding coverage, and making the best choice for your unique travel needs in 2025.

Why Travel Insurance is Essential

Before we dive into selection tips, let’s address why travel insurance is so important:

- Medical emergencies abroad: Healthcare costs can be extremely high in some countries.

- Flight disruptions: Airlines may not cover all costs of cancellations or long delays.

- Lost or stolen belongings: From luggage to electronics, replacing items abroad is costly.

- Unforeseen events: Natural disasters, strikes, or sudden illness can derail plans.

- Peace of mind: With insurance, you can focus on enjoying your adventure without financial stress.

Step 1: Assess Your Travel Needs

The first step in choosing the right plan is understanding your trip. Ask yourself:

- What is my destination?

- Countries like the USA, Switzerland, or Japan have higher healthcare costs, requiring stronger medical coverage.

- Some destinations may also require proof of travel insurance for entry.

- How long will I travel?

- A short trip may only require single-trip coverage.

- Frequent travelers may save money with annual multi-trip plans.

- What kind of traveler am I?

- Families need policies that cover children.

- Students may need tuition-related coverage.

- Adventure travelers should look for extreme sports add-ons.

- What valuables am I carrying?

- Laptops, cameras, and smartphones may need gadget protection.

Step 2: Understand the Types of Travel Insurance Plans

Not all plans are the same. Here are the most common categories:

1. Single-Trip Travel Insurance

- Covers one journey from departure to return.

- Ideal for occasional travelers.

2. Multi-Trip or Annual Travel Insurance

- Covers multiple trips within a year.

- Best for business travelers or frequent vacationers.

3. Family Travel Insurance

- Covers all family members under one policy.

- Often more affordable than buying individual plans.

4. Student Travel Insurance

- Tailored for international students.

- Includes tuition fee coverage, health insurance, and belongings.

5. Digital Nomad and Expat Insurance

- Designed for long-term stays abroad.

- Provides global healthcare and gadget protection.

6. Adventure or Sports Travel Insurance

- Covers high-risk activities like skiing, diving, or mountain climbing.

- Must be added separately in most cases.

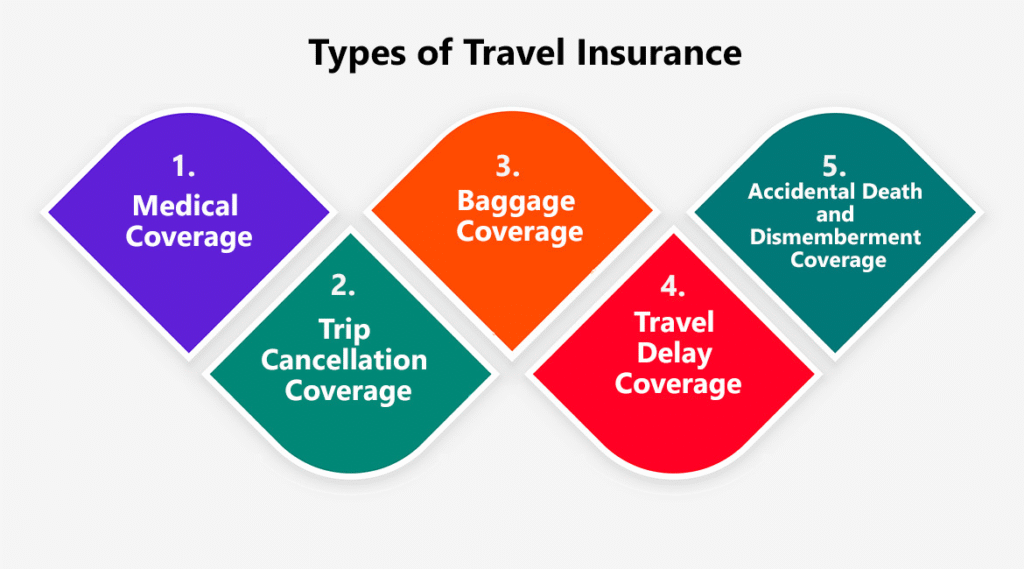

Step 3: Compare Key Coverage Areas

When comparing plans, always check the coverage details:

1. Medical Coverage

- Should cover hospitalization, surgery, and emergency evacuation.

- Look for coverage limits of at least $100,000 or more if traveling to expensive destinations.

2. Trip Cancellation and Interruption

- Refunds prepaid expenses for illness, natural disasters, or emergencies.

- Check if pandemics and epidemics are included.

3. Baggage and Belongings

- Covers lost, stolen, or delayed baggage.

- Confirm whether high-value electronics are included or require add-ons.

4. Flight Delays and Disruptions

- Provides food, lodging, or rebooking costs.

- Some providers offer automatic payouts for delays over a certain time.

5. Emergency Evacuation and Repatriation

- Covers transport to a safe location or back home during crises.

- Essential for natural disasters or political instability.

6. Accidental Death or Dismemberment (AD&D)

- Provides financial protection for your loved ones.

Step 4: Watch Out for Exclusions

Every travel insurance policy has limitations. Common exclusions include:

- Pre-existing medical conditions (unless covered in premium plans).

- Injuries from alcohol or drug use.

- Extreme sports not listed in the policy.

- Lost belongings left unattended.

- Travel to war zones or restricted areas.

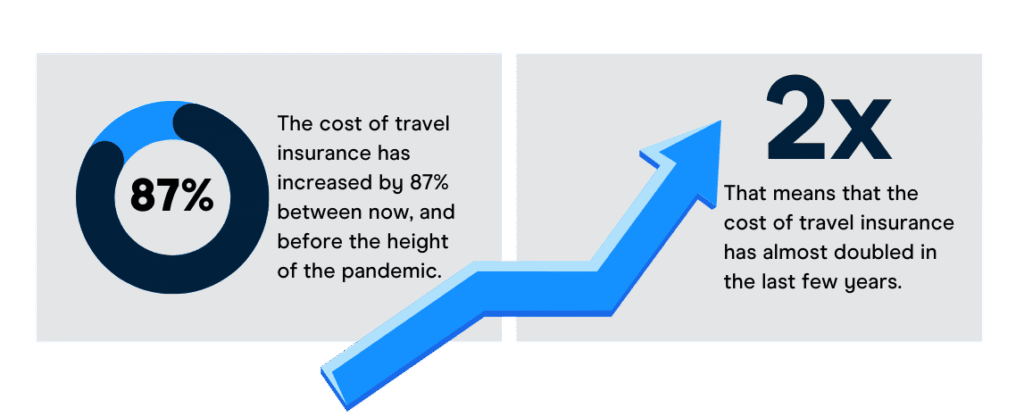

Step 5: Compare Costs vs. Benefits

Travel insurance typically costs 5–10% of your total trip budget. Factors that affect cost include:

- Destination country.

- Duration of travel.

- Traveler’s age.

- Coverage level.

- Add-ons for gadgets, sports, or rental cars.

Step 6: Check the Provider’s Reputation

A low premium is worthless if the provider is unreliable. Look for:

- Customer reviews about claims processing speed.

- 24/7 global assistance availability.

- Partnerships with hospitals worldwide.

- Financial stability of the insurance company.

Step 7: Take Advantage of Technology

Travel insurance in 2025 is smarter than ever:

- AI-powered claims: Faster processing times.

- Mobile apps: File claims and track coverage instantly.

- Wearable integrations: Personalized medical coverage.

- On-demand policies: Activate coverage for specific days or activities.

Step 8: Compare Top Providers

Some of the best global travel insurance providers in 2025 include:

- Allianz Travel Insurance – Comprehensive worldwide coverage.

- World Nomads – Perfect for adventure travelers.

- SafetyWing – Flexible, affordable digital nomad plans.

- AXA Assistance – Strong presence in Europe and Asia.

- Travelex Insurance Services – Great for families.

Step 9: Customize with Add-Ons

Don’t settle for a one-size-fits-all policy. Consider add-ons like:

- Adventure sports coverage.

- Gadget protection for laptops, drones, or cameras.

- Rental car insurance.

- Higher medical coverage limits.

Step 10: Buy at the Right Time

The best time to buy travel insurance is immediately after booking your trip. This ensures:

- Cancellation protection begins right away.

- You avoid exclusions for last-minute events.

SEO Keywords for This Article

- How to choose travel insurance

- Best travel insurance 2025

- Travel insurance plan comparison

- Travel insurance medical coverage

- Travel insurance cost

- Adventure travel insurance plans

SEO Meta Description

Wondering how to choose the right travel insurance plan? This 2025 guide covers types of policies, coverage details, costs, exclusions, and top providers to help you find the best fit.

Conclusion: Choosing the Right Travel Insurance Plan

Selecting the best travel insurance plan is not about finding the cheapest option — it’s about choosing the policy that fits your travel style, destination, and budget.

Quick Recap:

- Assess your travel needs (destination, trip length, activities).

- Understand the types of policies (single-trip, annual, family, student, digital nomad).

- Compare coverage areas and exclusions carefully.

- Balance costs vs. benefits instead of focusing on price alone.

- Pick a reputable provider with reliable claims processing.

- Customize with add-ons for adventure, gadgets, or car rentals.

With the right travel insurance plan, you can embark on your journey with complete peace of mind, knowing that no matter what surprises life throws your way, you’ll be financially protected.