Ultimate Guide to Travel Insurance: Travel insurance has become an essential part of trip planning for millions of adventurers, families, and business travelers worldwide. In 2025, with global travel rebounding post-pandemic and new risks emerging from climate change, geopolitical tensions, and health concerns, understanding travel insurance is more crucial than ever. This comprehensive guide will explore what travel insurance is, why you need it, the different types available, key coverage areas, how to choose the right policy, common exclusions, the claims process, and expert tips for buying. Whether you’re a solo backpacker, a family on vacation, or a senior explorer, this article will equip you with the knowledge to protect your journeys effectively.

Travel insurance acts as a safety net, covering unexpected events that could disrupt your trip or lead to financial losses. According to recent industry reports, the global travel insurance market is projected to grow significantly in 2025, driven by increased awareness of risks like medical emergencies abroad and trip cancellations. It’s not just about peace of mind; it’s about safeguarding your investment in flights, hotels, and experiences. In this guide, we’ll break down everything in detail to help you make informed decisions.

12 Best Travel Insurance Affiliate Programs | Travelpayouts

Why You Need Travel Insurance: Benefits and Real-World Scenarios

Imagine booking a dream vacation to Europe, only to have a sudden illness force you to cancel, or worse, require emergency medical care in a foreign hospital. Without travel insurance, you could face thousands in out-of-pocket expenses. Travel insurance provides financial protection against such uncertainties, ensuring you don’t lose money or face undue stress.

One primary benefit is trip cancellation coverage, which reimburses non-refundable expenses if you must cancel for covered reasons like illness, injury, or severe weather. In 2025, with unpredictable weather patterns due to climate change, this has become increasingly relevant. For instance, if a hurricane disrupts your Caribbean cruise, insurance can cover rebooking costs.

Medical coverage is another cornerstone. Domestic health insurance often doesn’t extend internationally, leaving you vulnerable to high medical bills. Travel insurance typically includes emergency medical expenses, hospital stays, and even dental care up to specified limits. High-quality plans offer up to $1 million in coverage, crucial for seniors or those with pre-existing conditions.

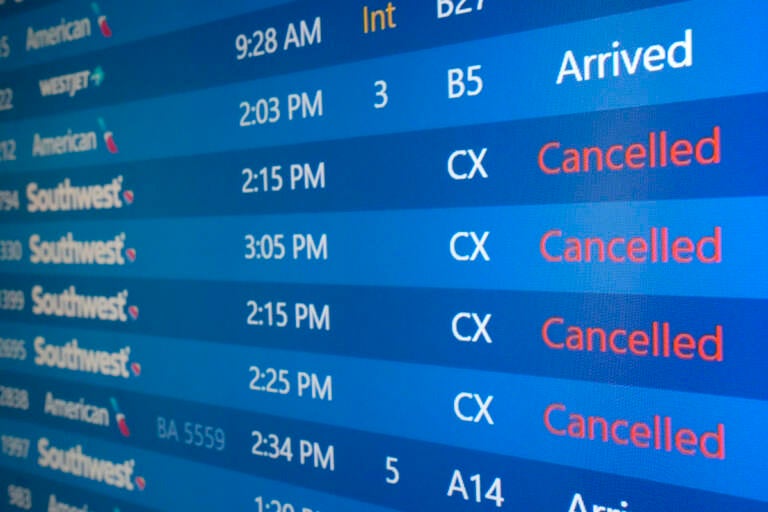

Baggage loss or delay is a common hassle at airports. Insurance compensates for lost, stolen, or delayed luggage, providing funds for essentials while you wait. Additionally, travel delay coverage helps with meals and accommodations if your flight is postponed.

For adventure seekers, policies can cover high-risk activities like skiing or scuba diving, which standard plans might exclude. Family trips benefit from coverage that includes children, ensuring everyone is protected during group travels.

In real-world scenarios, travel insurance has saved travelers from disasters. During the 2023 Maui wildfires, many insured visitors received reimbursements for evacuations and cancellations. In 2025, with rising cyber threats, some policies even include identity theft protection for digital nomads.

Overall, the benefits outweigh the costs—premiums often range from 4-10% of your trip cost, a small price for comprehensive security. Skipping it could lead to regret, especially in an era of global uncertainties.

TRAVELERS MEDICAL GUIDE 1.05 Planning and Preparedness–Accessing …

Types of Travel Insurance Policies: Finding the Right Fit

Travel insurance isn’t one-size-fits-all; various types cater to different needs. Understanding these will help you select the best option for your 2025 travels.

Single-Trip Insurance is ideal for one-off vacations. It covers a specific journey from departure to return, perfect for short holidays or business trips. Premiums are based on trip duration, destination, and coverage limits.

Annual or Multi-Trip Insurance suits frequent travelers. If you take multiple trips in a year, this policy provides coverage for all, up to a certain number of days per trip (often 30-90 days). It’s cost-effective for business professionals or retirees exploring the world.

Comprehensive Travel Insurance offers broad protection, including medical, cancellation, baggage, and more. This is the most popular type, recommended for international trips where risks are higher.

Medical-Only Travel Insurance focuses solely on health-related issues, ideal if your credit card already covers cancellations but not medical evacuations. In 2025, with aging populations traveling more, senior-specific plans emphasize higher medical limits and pre-existing condition waivers.

Adventure or Extreme Sports Insurance extends coverage to high-risk activities like rock climbing, skydiving, or off-piste skiing. Standard policies often exclude these, so add-ons are necessary for thrill-seekers.

Family Travel Insurance bundles coverage for groups, often at discounted rates. It includes child-specific benefits like coverage for school trips or family emergencies back home.

Cancel for Any Reason (CFAR) Insurance is a premium add-on allowing cancellations without specified reasons, reimbursing 50-75% of costs. It’s gained popularity post-COVID for flexibility.

Group Travel Insurance is for organized tours or corporate events, covering multiple people under one policy.

When choosing, consider your travel style. For example, digital nomads might opt for long-term policies with gadget coverage, while families prioritize child-inclusive plans.

Extreme Sports Travel Insurance – Hazardous Activity Cover

Key Coverage Areas in Travel Insurance

A good travel insurance policy covers several core areas to ensure holistic protection.

Trip Cancellation and Interruption: Reimburses for unforeseen cancellations or early returns due to illness, death in the family, or natural disasters. Limits often match your trip cost.

Emergency Medical and Evacuation: Covers doctor visits, surgeries, and transport to better facilities. Evacuation can cost $50,000-$100,000 without insurance, making this vital.

Baggage and Personal Effects: Protects against loss, theft, or damage. Some plans include coverage for high-value items like cameras or jewelry with riders.

Travel Delay: Provides for extra expenses if delayed by weather, mechanical issues, or strikes. Thresholds are usually 6-12 hours.

Accidental Death and Dismemberment: Offers lump-sum payments for severe injuries or death during travel.

Rental Car Coverage: Extends to damage or theft of rented vehicles, often cheaper than rental company add-ons.

24/7 Assistance: Many insurers provide helplines for medical referrals, legal aid, or translation services.

In 2025, emerging coverages include pandemic-related protections, cyber security for online bookings, and sustainable travel options for eco-conscious trips. Always review limits—medical coverage should be at least $100,000 for international trips.

Bad weather cancelling flights? Here’s what you need to know – WHYY

How to Choose the Best Travel Insurance Policy

Selecting the right travel insurance involves careful evaluation. Start by assessing your needs: Destination (high-risk areas need more coverage), trip length, activities, and health status.

Compare providers using aggregator sites like NerdWallet or InsureMyTrip. Look at ratings from AM Best for financial stability and customer reviews on Trustpilot.

Evaluate coverage limits and deductibles. Higher limits mean higher premiums, but skimping could be costly. Check for pre-existing condition waivers—buy early (within 14-21 days of booking) to qualify.

Consider add-ons like CFAR or adventure sports if needed. For families, ensure policies cover minors without extra fees.

Cost is a factor, but don’t choose solely on price. A cheap policy might have low limits or many exclusions. In 2025, expect premiums to rise slightly due to inflation, averaging $200-$500 for a $5,000 trip.

Read the fine print for exclusions and claims ease. Opt for insurers with app-based claims for quick processing.

Finally, buy from reputable companies like Allianz, World Nomads, or Seven Corners, known for reliable service.

Baggage Insurance – Protection for Luggage Loss, Delay & Theft

Common Exclusions and Limitations in Travel Insurance

No policy covers everything; understanding exclusions prevents surprises.

Pre-Existing Conditions: Most plans exclude illnesses treated within 60-180 days before purchase, unless waived.

High-Risk Activities: Base jumping or unlicensed driving might not be covered without add-ons.

Intentional Acts: Self-inflicted injuries or illegal activities are excluded.

Pandemics and Known Events: If you travel to a warned area (e.g., war zones), coverage may be void.

Normal Wear and Tear: Baggage damage from regular use isn’t reimbursed.

Alcohol-Related Incidents: Injuries while intoxicated are often excluded.

Limits on Valuables: High-end items need separate scheduling.

In 2025, exclusions for AI-related travel disruptions (like automated booking errors) might emerge. Always check the policy wording.

The Claims Process: Step-by-Step Guide

Filing a claim should be straightforward. First, contact your insurer immediately—many have 24/7 hotlines.

Gather documentation: Receipts, medical reports, police statements for theft, or airline confirmations for delays.

Submit via app, email, or portal within the deadline (usually 30-90 days).

The insurer reviews and reimburses approved amounts, minus deductibles. Processing takes 2-6 weeks.

Tips: Keep copies of everything and follow up. If denied, appeal with more evidence.

Why Your Family Needs International Travel Insurance

Tips for Buying Travel Insurance in 2025

- Buy early to lock in rates and qualify for waivers.

- Use comparison tools for the best deals.

- Check credit card perks—some offer basic coverage.

- Read reviews and policy details thoroughly.

- Consider eco-friendly insurers for sustainable options.

- For seniors, prioritize medical-focused plans.

The Best Travel Insurance for Seniors | International Citizens …

Conclusion: Secure Your Adventures with Travel Insurance

In 2025, travel insurance is indispensable for safe, enjoyable trips. By understanding benefits, types, and how to choose, you can avoid financial pitfalls. Remember, the right policy turns potential disasters into minor hiccups. Plan ahead, travel smart, and explore the world confidently.