Top Legal Malpractice Insurance for Lawyers in 2026: As the legal profession evolves rapidly in the face of technological advancements, regulatory shifts, and increasing client expectations, lawyers’ professional liability insurance—commonly known as legal malpractice insurance—remains a critical safeguard. In 2025, the average cost of a legal malpractice claim has surged, with severity hitting all-time highs due to complex cases and economic pressures. Looking ahead to 2026 and beyond, experts predict a market influenced by AI integration, cyber risks, and proactive risk management strategies. This comprehensive guide explores the top insurance options for lawyers, emerging trends, and how to secure the best coverage. Whether you’re a solo practitioner or part of a large firm, understanding these elements can protect your practice from financial ruin.

With over 1.3 million active lawyers in the U.S., the demand for robust insurance is skyrocketing. Claims data from 2020-2023 shows that nearly 47% of malpractice suits stem from substantive errors like failure to know the law or procedural mistakes. As we delve into 2026 projections, this article provides actionable insights to help you navigate the landscape, optimized for those searching for “best lawyers insurance 2026” or “future of legal malpractice coverage.”

What is Lawyers’ Professional Liability Insurance?

Lawyers’ professional liability insurance (LPL) protects legal professionals against claims of negligence, errors, or omissions in their services that result in client financial harm. Unlike general liability insurance, which covers bodily injury or property damage, LPL focuses on professional mistakes—such as missing deadlines, conflicts of interest, or inadequate advice. This coverage is essential because even the most diligent attorneys can face lawsuits; in fact, studies indicate that claim frequency has risen steadily, with conflicts of interest and poor communication leading the pack.

There are two main policy types: claims-made and occurrence-based. Claims-made policies cover incidents reported during the policy period, often requiring tail coverage for post-policy claims. Occurrence-based policies cover events that happen while the policy is active, regardless of when the claim is filed. For lawyers, additional riders like cyber liability are increasingly vital, as data breaches in law firms have spiked by 20% in recent years.

Costs vary by firm size, location, and practice area. Solo practitioners might pay $1,000-$3,000 annually for $1 million in coverage, while larger firms could exceed $10,000 per attorney. High-risk areas like real estate or family law often incur higher premiums due to elevated claim risks. In states like Ohio, 2025 regulatory changes mandate minimum coverage levels, a trend expected to expand nationwide by 2026.

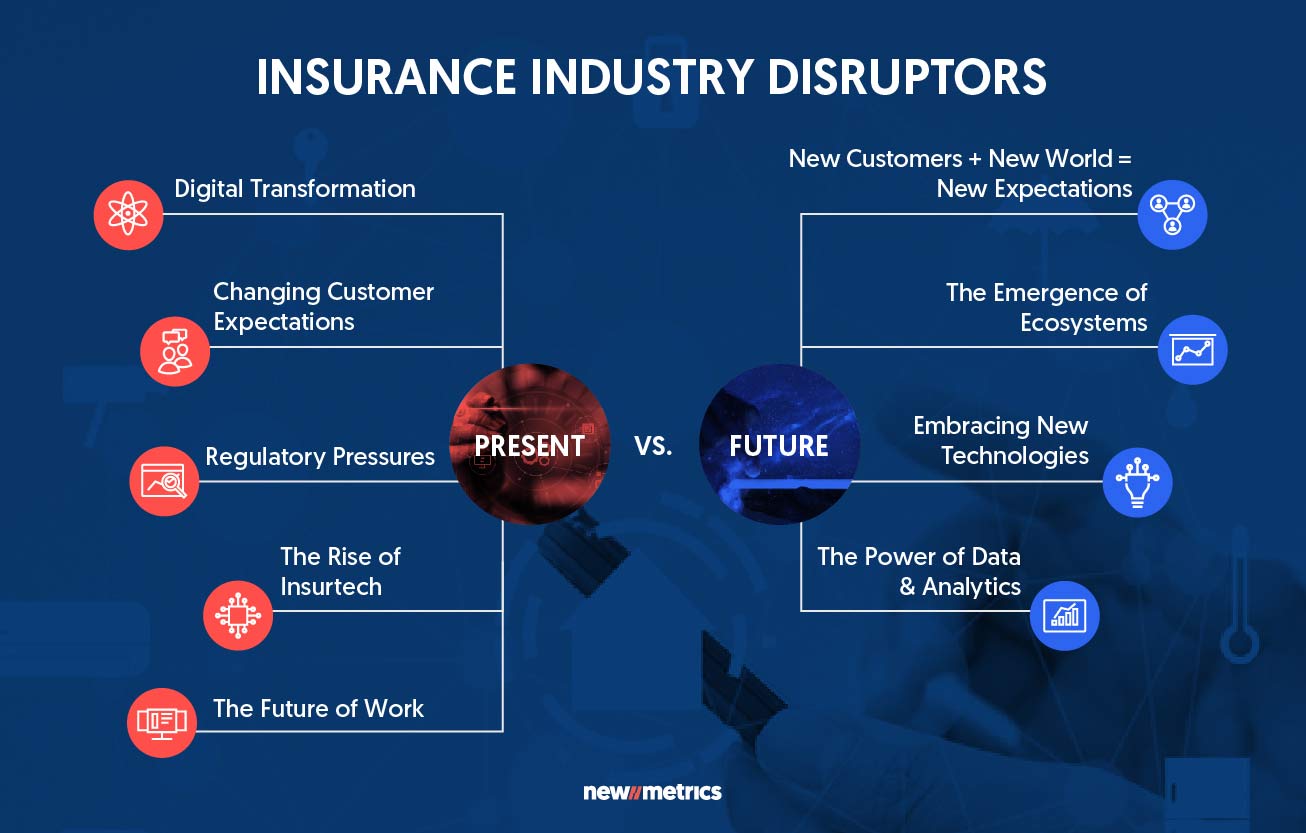

Insurance Industry Disruptors: Present vs. Future

Top Providers for Lawyers’ Insurance in 2026

Based on 2025 excellence awards and market share, several insurers stand out for their comprehensive LPL offerings. CNA leads the pack, insuring over 50,000 firms and 155,000 lawyers with tailored policies that include risk management resources. Their focus on proactive tools, like AI-driven claim prediction, positions them well for 2026’s tech-heavy landscape.

Travelers offers robust coverage for negligence and omissions, with flexible limits and endorsements for cyber risks—crucial as remote work persists. The Hartford earns top marks for supplementary coverages, including business owners’ policies (BOP) that bundle LPL with general liability. For small firms, NEXT provides quick claims resolution and affordable rates, scoring high in 2025 reviews.

Other notables include:

- Allied World Assurance Company: Excels in high-exposure claims, ideal for litigators.

- Berkley Professional Liability: Strong in customizable policies for niche practices like intellectual property.

- Markel American Insurance Company: Known for broad exclusions and competitive pricing.

- RSUI and CFC Underwriting: Focus on innovative E&O solutions, including AI-related liabilities.

The American Bar Association (ABA) maintains a directory of over 20 carriers, making it easier to compare options. For California lawyers, Lawyers’ Mutual offers state-specific protections. In 2026, expect providers like Simply Business to dominate with easy quote comparisons via digital platforms.

Future Trends Shaping Lawyers’ Insurance in 2026 and Beyond

The legal malpractice insurance market is poised for transformation, driven by several key trends identified in recent surveys. First, the integration of artificial intelligence (AI) is revolutionizing risk assessment. Insurers are using AI to predict claims, with tools analyzing case histories to flag potential errors like missed deadlines. However, this introduces new liabilities—such as AI-generated advice leading to malpractice suits—prompting policies to include “tech error” clauses.

Cyber risks are another major shift. With law firms handling sensitive data, breaches have become commonplace; 2025 saw a 15% increase in cyber-related claims. By 2026, expect bundled cyber coverage to be standard, especially in hybrid work environments. The “silver tsunami”—aging attorneys retiring—will also impact the market, as firms face succession planning risks and higher claims from experienced lawyers.

Economic factors, including inflation and regulatory changes, are pushing premiums up by 5-10% annually. Tort reform in states like Texas could cap damages, lowering costs, while evolving regulations around telehealth and virtual consultations add layers of exposure. Insurtech rise is democratizing access, with platforms offering instant quotes and personalized policies via big data analytics.

AI and the Future of Legal Practice

Proactive risk management is trending, with firms adopting year-end reviews to adjust coverage. EPIC’s 2025 survey highlights conflicts, fee disputes, and administrative errors as top claim drivers, urging insurers to offer preventive training. Overall, the market is shifting from reactive to preventive, with “more is more” approaches to coverage.

How to Choose the Best Insurance for Your Law Practice

Selecting the right LPL policy requires evaluating your firm’s needs. Start by assessing risk levels—high-litigation areas like personal injury demand higher limits. Compare quotes from multiple carriers using ABA’s directory or brokers like Attorneys Liability Protection Society.

Key factors include:

- Coverage Scope: Ensure it includes prior acts, defense costs, and disciplinary proceedings.

- Limits and Deductibles: Aim for $1-5 million per claim, balancing premiums with protection.

- Exclusions: Watch for gaps in cyber or AI-related claims.

- Claims Handling: Providers like NEXT excel in quick resolutions.

- Additional Perks: Look for risk management tools, like CNA’s educational resources.

For 2026, prioritize insurers embracing insurtech for seamless digital experiences. Consult with specialists to tailor policies, especially if your firm handles international clients or emerging fields like blockchain law.

Tips for Minimizing Risks and Claims

Preventing claims is as important as insuring against them. Common pitfalls include inadequate discovery (8.9% of claims) and failure to file documents timely (8.1%). Implement robust conflict checks and client communication protocols.

Expert tips:

- Use AI tools judiciously to avoid new liabilities.

- Conduct annual audits and train staff on cyber hygiene.

- Document all advice to counter “he said, she said” disputes.

- Avoid suing clients for fees, as it often triggers counterclaims.

- Stay updated on regulatory changes, like Ohio’s 2025 mandates.

By 2026, firms with strong risk cultures could see premium reductions of up to 15%.

Resources for Securing Lawyers’ Insurance

Leverage the ABA’s carrier list for starters. Platforms like Embroker provide trend reports and quotes. For claims data, consult the ABA’s Profile of Legal Malpractice Claims. State bar associations offer guidance, and insurers like Travelers provide free risk assessments.

In conclusion, as we approach 2026, top lawyers’ insurance will emphasize tech integration, comprehensive cyber protection, and preventive strategies. By choosing providers like CNA or Travelers and staying ahead of trends, you can safeguard your practice effectively. Start reviewing your coverage today to thrive in tomorrow’s legal world.