The Electric Bus Service Initiative: In an era where climate change and urban congestion dominate global headlines, the Electric Bus Service Initiative emerges as a beacon of sustainable progress. This multifaceted program encompasses worldwide efforts to transition public and school transportation fleets to zero-emission electric buses. From bustling city streets to school routes, electric buses promise cleaner air, reduced costs, and enhanced energy efficiency. As governments, organizations, and manufacturers rally behind this initiative, the adoption of electric bus services has surged, with global sales reaching nearly 50,000 units in 2023 alone. By 2025, the momentum shows no signs of slowing, positioning electric buses as a cornerstone of green public transport.

The Electric Bus Service Initiative isn’t a single policy but a collective movement driven by environmental imperatives and technological advancements. In the United States, the World Resources Institute’s (WRI) Electric School Bus Initiative targets full electrification of the nation’s 500,000 school buses by 2030, with over 5,100 already on roads by mid-2025—a staggering increase from just 415 in 2020. Globally, initiatives like Europe’s push for 108,000 zero-emission buses by 2030 and China’s dominance in electric bus manufacturing underscore the initiative’s scope. This article delves into the history, technologies, benefits, challenges, and future of the Electric Bus Service Initiative, highlighting how it’s transforming electric bus services into a viable, scalable solution for sustainable mobility.

The Evolution of the Electric Bus Service Initiative

The roots of electric bus technology trace back to the late 19th century, when early electric trolleys powered urban transport. However, diesel dominance in the mid-20th century sidelined electrics due to cheaper fuel and longer ranges. The resurgence began in the 2000s, fueled by rising oil prices, air quality concerns, and climate agreements like the Paris Accord.

A pivotal moment came in 2010 when China launched aggressive subsidies under its New Energy Vehicle (NEV) program, catapulting it to lead global electric bus adoption. By 2023, China accounted for 60% of worldwide electric bus sales, with exports flooding markets in Europe and Latin America. In Europe, the European Union’s Clean Vehicles Directive (2009) mandated greener fleets, leading to projects like Amsterdam’s 100-bus fleet operated by Connexxion since 2018.

The Electric Bus Service Initiative gained formal traction in the 2010s through public-private partnerships. In the US, the Federal Transit Administration’s Low or No Emission Vehicle Program (2014) allocated billions for electric transit buses. Meanwhile, school-focused efforts like the EPA’s Clean School Bus Program (2022) injected $5 billion over five years to replace diesel models. By 2025, initiatives such as India’s National Electric Bus Program (NEBP) aim for 50,000 electric buses by 2030, supported by the FAME-II scheme that has already deployed over 10,000 units.

These programs reflect a shift from pilot projects to widespread implementation. In Latin America, Santiago, Chile, leads with a goal of 68% electrification by March 2026, serving millions daily. The initiative’s growth is evident: global electric bus stock hit 635,000 by 2023, up from negligible numbers a decade prior.

Key Global Electric Bus Service Initiatives

The Electric Bus Service Initiative manifests differently across regions, tailored to local needs but united by sustainability goals.

United States: Focus on School and Transit Fleets

In the US, the WRI’s Electric School Bus Initiative, launched in partnership with the Bezos Earth Fund, seeks equitable electrification, prioritizing underserved communities. By July 2025, electric school buses numbered over 5,100, with utilities like those in the New England Electric Bus Initiative (NEEBI) partnering for charging infrastructure. Ann Arbor Public Schools’ initiative targets 100% electric by 2035, reducing emissions and operational costs.

For public transit, Los Angeles’ Foothill Transit pioneered double-decker electrics in 2018, while cities like Indianapolis deployed 13 BYD K11 models. The EPA’s funding in 2024 supported 2,400 zero-emission vehicles, 70% for schools. Manufacturers like Proterra and Blue Bird dominate, with sales surging 12% in 2023.

Europe: Pioneering Urban Electrification

Europe boasts the most advanced electric bus services, with 5,315 battery-electric registrations in the first half of 2025—a 41% year-over-year jump. The Netherlands leads, with Amsterdam’s Schiphol fleet covering 30,000 km daily using VDL buses. Rotterdam’s RET operates 55 VDL units, and Qbuzz in Groningen-Drenthe runs over 160 from Ebusco and VDL.

London’s Go-Ahead aims for 1,000 zero-emission buses by 2026, part of a 2037 full-fleet goal. In Germany, Hamburg’s Hochbahn added 10 Solaris Urbino 12 electrics, while Berlin’s BVG runs 107 Solaris models. Manufacturers like Solaris (15.2% market share in 2023), Yutong, and Daimler Buses (eCitaro, 1,000 units by 2023) drive innovation. Countries like the Netherlands, Finland, Switzerland, and Denmark have over 60% electric bus sales shares.

Asia and Emerging Markets: Scaling Rapidly

China’s dominance is unmatched, with exports comprising 30% of Europe’s market by 2023. Shenzhen operates the world’s largest all-electric fleet of 16,000 buses since 2017.

India’s NEBP, under PM e-Bus Sewa Scheme-2, targets 10,000 buses in 169 cities, with JBM Auto securing 1,021 units. Tata Motors holds 40% market share with 1,431 registrations in 2024.

In Latin America, Bogota and Santiago have deployed 6,500 electrics combined. Africa’s BasiGo plans 1,200 buses in Kenya and Rwanda by 2025. Dakar’s all-electric BRT, announced in 2023, serves 320,000 passengers daily.

These initiatives highlight collaborative efforts, from policy incentives to infrastructure investments, accelerating electric bus service deployment.

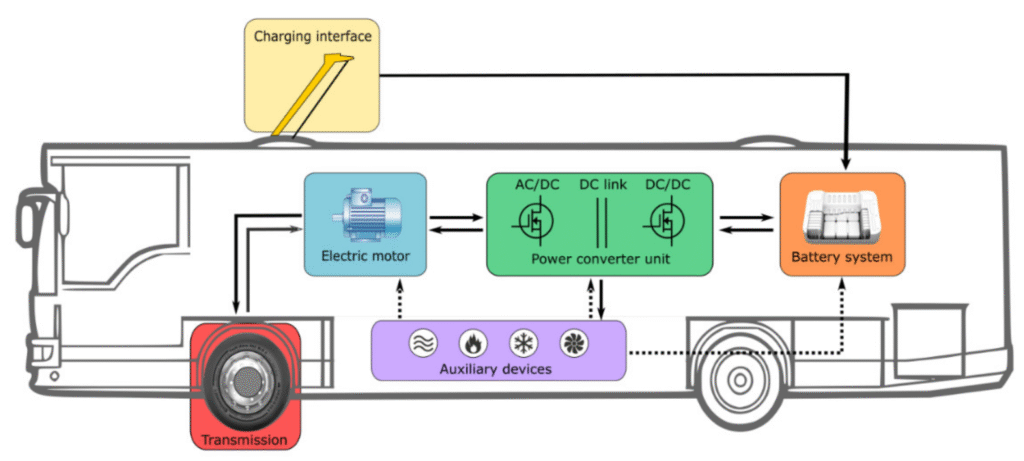

Technology and Infrastructure in Electric Bus Services

At the heart of the Electric Bus Service Initiative lies advanced battery technology, primarily lithium-ion packs offering 200-300 km ranges per charge. Fast-charging systems, like those from Heliox in The Hague, enable opportunity charging during stops. Manufacturers integrate regenerative braking and smart energy management for efficiency.

Infrastructure is crucial: depots with pantograph chargers support overnight and depot charging. In Europe, the EU’s Alternative Fuels Infrastructure Directive mandates expansion. Wireless charging trials in Israel and Sweden pave the way for seamless operations. Costs have plummeted—battery prices fell 89% since 2010—making electrics competitive with diesel over lifecycle.

Benefits of the Electric Bus Service Initiative

The advantages of electric bus services are profound, spanning environmental, economic, and social realms.

Environmentally, electric buses cut greenhouse gas emissions by up to 70% compared to diesel, improving urban air quality and reducing health issues like asthma in children near school routes. Globally, they could slash transport CO2 by 1.7 gigatons annually by 2030 if scaled.

Economically, total ownership costs are 20-30% lower due to cheaper electricity (half diesel’s price) and minimal maintenance—no oil changes or engine overhauls. In the US, school districts save $1,000 per bus annually on fuel. Initiatives create jobs in manufacturing and charging networks, with China’s sector employing millions.

Socially, quieter rides enhance passenger comfort, and equitable access benefits low-income areas. Programs like WRI’s prioritize justice, ensuring clean air for vulnerable populations. Electric buses also reduce noise pollution by 10-15 decibels, fostering livable cities.

Challenges Facing Electric Bus Adoption

Despite progress, hurdles remain. High upfront costs—$500,000 per bus versus $300,000 for diesel—deter adoption, though subsidies mitigate this. Range anxiety persists for longer routes, and grid strain from charging demands investment; a single depot might require 1 MW capacity.

Supply chain issues, like battery mineral shortages, and skilled labor gaps slow rollout. In emerging markets, financing is scarce, as seen in India’s 2022 lending hesitancy. Solutions include battery swapping, second-life batteries for storage, and international aid like the IFC’s financing models.

The Future of Electric Bus Service Initiatives

Looking ahead, the Electric Bus Service Initiative will benefit from falling battery costs and policy support. The EU’s 100% ZEV target by 2035 and global net-zero pledges will drive growth to 1 million electric buses by 2030. Innovations like solid-state batteries promise 500+ km ranges, while AI optimizes routes for efficiency.

In 2025 and beyond, integration with smart cities—via V2G tech returning power to grids—will amplify impacts. Initiatives like RMI’s e-Bus program ensure inclusive scaling worldwide.

Conclusion: Accelerating the Shift to Electric Bus Services

The Electric Bus Service Initiative is more than a trend—it’s a transformative force reshaping transportation. From the US’s school bus revolution to Europe’s urban fleets and Asia’s massive deployments, electric buses deliver sustainability without compromise. As adoption accelerates, benefits will compound, creating healthier, greener cities. Stakeholders must collaborate to overcome challenges, ensuring every bus route contributes to a zero-emission future. Embracing this initiative today paves the way for tomorrow’s sustainable mobility.